With US equities seeing another day of broad weakness, the VIX was naturally on the rise, settling +21.4% @ 24.99. Near term outlook offers the sp'1920/00 zone, and that might equate to VIX in the low 30s. If next Monday is crashy to the sp'1700s though... VIX will explode to the 55/65 zone.

VIX'60min

VIX'daily3

Summary

re: VIX 55/65

If the Friday equity close is at/near the lows of the day/week - in the sp'1920/00 zone, then the outlook for the Monday open will be exceptionally bearish.

If equities opened lower by 5-7%, then VIX would jump into the 50s.. perhaps even 60s.

There should be clarity of whether that scenario is viable at 3.55pm Friday.

--

*I am long VIX via TVIX. I am seeking at least another push higher in the VIX, but with a viable explosion next Monday.

-

more later... on the indexes

Thursday 7 January 2016

Closing Brief

US equities closed significantly lower for the third trading day of four this year, sp -47pts @ 1943. The two leaders - Trans/R2K, settled -3.1% and -2.7% respectively. Near term outlook is for continued weakness to the sp'1920/00 zone. If the Friday close is at/near the lows.. Monday will likely see a mini-crash capitulation in the 1700s.

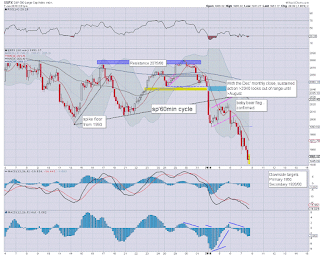

sp'60min

Summary

*closing hour action: a lot of chop, but with a new cycle low of 1938.

-

So... another day for the equity bears, and the mainstream are getting notably twitchy. There is increasing talk of 'the next 2008', the China upset, weak commodities, and just plain weak earnings.

Clearly though.. we're likely no more than a day or two away from a capitulation low.

The only issue is whether that is the sp'1920/00 zone... or a brief crashy washout in the 1700s.

--

**I have had a case of trader-paralysis for some days.

However, in the closing hour I did pick up a small block of TVIX. The actual stock.. not options. I have little tolerance lately, and rather than play VIX calls (notoriously problematic to offload in a market crash), I think I might get into the habit of meddling in TVIX as a VIX-long vehicle.

In any case... I'm on the short train... at least a little.

--

more later.... on the VIX

sp'60min

Summary

*closing hour action: a lot of chop, but with a new cycle low of 1938.

-

So... another day for the equity bears, and the mainstream are getting notably twitchy. There is increasing talk of 'the next 2008', the China upset, weak commodities, and just plain weak earnings.

Clearly though.. we're likely no more than a day or two away from a capitulation low.

The only issue is whether that is the sp'1920/00 zone... or a brief crashy washout in the 1700s.

--

**I have had a case of trader-paralysis for some days.

However, in the closing hour I did pick up a small block of TVIX. The actual stock.. not options. I have little tolerance lately, and rather than play VIX calls (notoriously problematic to offload in a market crash), I think I might get into the habit of meddling in TVIX as a VIX-long vehicle.

In any case... I'm on the short train... at least a little.

--

more later.... on the VIX

3pm update - just another down day

US equities remain very significantly lower, with the sp' having broken a new cycle low of 1941, with VIX confirming the increasing market upset, @ 25.57. Gold is holding another fear-bid gain of $15. Oil remains somewhat choppy, but weak, -1.7%.

sp'60min

VIX'60min

Summary

There is ZERO reason to think 1942 is a key low, any more than 1989, or 1979.

With VIX already in the 25s, next level is the 30 threshold.

Indeed, if sp'1920/00s tomorrow, then VIX could max out in the 31/33 zone.

-

The Friday close will be critical. There is HIGH risk of a Monday washout of another 125/150pts.

We should have clarity of that issue by 3.55pm tomorrow.

--

notable weakness...

AAPL -3%

CHK -5%

FCX -11%

TWTR -4.2%... as most momo stocks are also unwanted

strength: GDX, +4.7%.. as the precious metals hold that fear-bid... but it won't last.

-

3.25pm.... sp -49pts... @ 2041

*I've been suffering from trader paralysis for some days... however, I am now long VIX.. via TVIX. Stock.. NOT options.

-

3.32pm... sp' breaks a new low of 1938... with VIX 25.86.

A move to 1920/00 zone looks a given... that should offer VIX close to 30.

-

3.41pm.. chop chop.... but clearly.. another day for the equity bears.

Ohh lookie.. Mr Mcclellan

back at the close

sp'60min

VIX'60min

Summary

There is ZERO reason to think 1942 is a key low, any more than 1989, or 1979.

With VIX already in the 25s, next level is the 30 threshold.

Indeed, if sp'1920/00s tomorrow, then VIX could max out in the 31/33 zone.

-

The Friday close will be critical. There is HIGH risk of a Monday washout of another 125/150pts.

We should have clarity of that issue by 3.55pm tomorrow.

--

notable weakness...

AAPL -3%

CHK -5%

FCX -11%

TWTR -4.2%... as most momo stocks are also unwanted

strength: GDX, +4.7%.. as the precious metals hold that fear-bid... but it won't last.

-

3.25pm.... sp -49pts... @ 2041

*I've been suffering from trader paralysis for some days... however, I am now long VIX.. via TVIX. Stock.. NOT options.

-

3.32pm... sp' breaks a new low of 1938... with VIX 25.86.

A move to 1920/00 zone looks a given... that should offer VIX close to 30.

-

3.41pm.. chop chop.... but clearly.. another day for the equity bears.

Ohh lookie.. Mr Mcclellan

back at the close

2pm update - another bear flag plays out

With a break to a new intra low of sp'1942, this mornings bear flag has already played out. The VIX confirms the increasing downward price pressure in equities, with a new high of 25.23. Further equity weakness looks due.. at least to the 1920/00 zone. How Friday closes is what now matters.

sp'15min

sp'daily5

Summary

*with a move below the lower gap zone of 1951, there is empty air to the 1920/00 zone.

--

Well, its getting tiresome to me....

.. as the mainsteam, and indeed, some I personally know.. they just don't see it.

They.. simply... .don't ... see........ it........ coming.

--

.. and right now.. I got nothing else to add.

sp'15min

sp'daily5

Summary

*with a move below the lower gap zone of 1951, there is empty air to the 1920/00 zone.

--

Well, its getting tiresome to me....

.. as the mainsteam, and indeed, some I personally know.. they just don't see it.

They.. simply... .don't ... see........ it........ coming.

--

.. and right now.. I got nothing else to add.

1pm update - VIX breaks a new high

Whilst equities have cooled back to the low sp'1960s, it is notable that the VIX has broken a new intra high of 23.88. The 25/26s look an easy target, if sp'1920/00 zone. It remains the case that any price action <1900 would likely lead to a very brief, but rather severe cascade to the 1700s.

VIX'60min

sp'15min

Summary

So... VIX breaks a new high.. whilst the indexes continue to churn out what is arguably just another bear flag.

-

ohh, and I realise some are still bullish about the China circuit breaker issue, but then.. the 'breaker issue' is something I've occasionally noted for a few years.

Breakers unquestionably make the situation worse.

Ironically today, no one has brought up the issue that US breaker levels were tightened in the past year or two.

--

1.14pm.. Well, with a new low of 1953, the bear flag is already confirmed.... along with confirmation via VIX 24s.

A close in the 1940s is now pretty likely...with 1920/00 zone for the Friday open.

The ultimate issue is how Friday closes. A close near the low... and Monday will be likely crashy.

Mainstream are clearly getting twitchy..

as Cramer is being dragged on for sporadic appearences during the day shows...

VIX'60min

sp'15min

Summary

So... VIX breaks a new high.. whilst the indexes continue to churn out what is arguably just another bear flag.

-

ohh, and I realise some are still bullish about the China circuit breaker issue, but then.. the 'breaker issue' is something I've occasionally noted for a few years.

Breakers unquestionably make the situation worse.

Ironically today, no one has brought up the issue that US breaker levels were tightened in the past year or two.

--

1.14pm.. Well, with a new low of 1953, the bear flag is already confirmed.... along with confirmation via VIX 24s.

A close in the 1940s is now pretty likely...with 1920/00 zone for the Friday open.

The ultimate issue is how Friday closes. A close near the low... and Monday will be likely crashy.

Mainstream are clearly getting twitchy..

as Cramer is being dragged on for sporadic appearences during the day shows...

12pm update - another bear flag... probably

US equities are seeing increasing chop, in what is almost certainly the creation of another bear flag. The earlier low of sp'1954 is not likely a capitulation low, and the 1920/00 zone looks highly probable.. whether tomorrow.. or next Monday.

sp'15min

sp'daily5

Summary

The gap fill to 1954 is interesting, and normally, that would make for a very natural low... but it does still feel like we'll see at least another major wave lower to wash the market out.

*I am somewhat bemused how the suspension of circuit breakers in China is now being twisted as a positive thing for stocks.

Am I really the only sane one on planet crazy today?

--

VIX update from Mr T.

--

time for lunch

sp'15min

sp'daily5

Summary

The gap fill to 1954 is interesting, and normally, that would make for a very natural low... but it does still feel like we'll see at least another major wave lower to wash the market out.

*I am somewhat bemused how the suspension of circuit breakers in China is now being twisted as a positive thing for stocks.

Am I really the only sane one on planet crazy today?

--

VIX update from Mr T.

--

time for lunch

11am update - NOW SELLING

US equities remain broadly weak, with the sp -18pts @ 1972. The early low of 1954 would make sense for a short term low (having filled the gap from 3 months ago), but there is currently ZERO sign of actual capitulation. Further weakness to at least 1920/00 looks due... whether tomorrow... or Monday.

sp'60min

VIX'60min

Summary

We're seeing a rather natural bounce from the gap zone... but all things considered, I don't see 1954 as a key low. It would seem HIGHLY likely we'll trade down to 1920/00 tomorrow/Monday.

To be absolutely clear...

If we close Friday close to/at the low of the week, I'd give odds of 75/80% that Monday will open -100/125 handles into the sp'1700s. That would make for short term capitulation in markets across the world, with a bounce into February/March.

--

Meanwhile... in a semi-flooded London city....

There remains an immense amount of house building across the capital, not least as mainland Europeans want a secondary home in a more secure location. In terms of prices, the London property market has peaked. There is also the 'crane indicator'. With so many construction cranes across the skyline, it is highly indicative of a bubble peak.

Maybe the ruling Gov't will want to mandate that everyone above the age of 20 to take out a subsidised mortgage of $250/350,000 ? After all, more debt will help the economy, yes?

Have no doubt... some crazy ass Govt' policies/directives are coming, not just in communist China, but across the western world.

--

time to cook

sp'60min

VIX'60min

Summary

We're seeing a rather natural bounce from the gap zone... but all things considered, I don't see 1954 as a key low. It would seem HIGHLY likely we'll trade down to 1920/00 tomorrow/Monday.

To be absolutely clear...

If we close Friday close to/at the low of the week, I'd give odds of 75/80% that Monday will open -100/125 handles into the sp'1700s. That would make for short term capitulation in markets across the world, with a bounce into February/March.

--

Meanwhile... in a semi-flooded London city....

| Finally.. Golden light |

| It IS a sign. Everything must be sold! |

There remains an immense amount of house building across the capital, not least as mainland Europeans want a secondary home in a more secure location. In terms of prices, the London property market has peaked. There is also the 'crane indicator'. With so many construction cranes across the skyline, it is highly indicative of a bubble peak.

Maybe the ruling Gov't will want to mandate that everyone above the age of 20 to take out a subsidised mortgage of $250/350,000 ? After all, more debt will help the economy, yes?

Have no doubt... some crazy ass Govt' policies/directives are coming, not just in communist China, but across the western world.

--

time to cook

10am update - opening declines

US equities open significantly lower, with a provisional low of sp'1954 - the upper end of the gap zone (1954/51). Considering other world markets (and overnight US ES futures levels), further weakness to the sp'1920/00 zone looks highly probable.

sp'daily5

sp'weekly1b

sp'monthly2

Summary

*note the lower Keltner band in the 1760s.

I'll try to cover it more later... but it is a fair question to ask whether this is the equivalent of January 2008... or July 2008. Every cycle is unique of course, but the style of decline is often similar.

--

China news: the communists have decided to cancel circuit breakers for Jan'8th.

So.. there you have it... they have already decided to 'let it go'.... no more attempts to hold 3K. The door is open to 2500 in the short term.

--

As for US markets...

From a pure cyclical perspective, equity bears face the ticking clock... as there is probably no more than another 1-2 days left of the current down wave from last Tuesday's high (sp'2081).

We'll likely floor tomorrow on 'jobs Friday'.... or via a flash-crash in the 1750s next Monday.

Either way... anyone short should be increasingly cautious as we move toward the sp'1920/00 zone.

--

*time for a little sun.. back soon

sp'daily5

sp'weekly1b

sp'monthly2

Summary

*note the lower Keltner band in the 1760s.

I'll try to cover it more later... but it is a fair question to ask whether this is the equivalent of January 2008... or July 2008. Every cycle is unique of course, but the style of decline is often similar.

--

China news: the communists have decided to cancel circuit breakers for Jan'8th.

So.. there you have it... they have already decided to 'let it go'.... no more attempts to hold 3K. The door is open to 2500 in the short term.

--

As for US markets...

From a pure cyclical perspective, equity bears face the ticking clock... as there is probably no more than another 1-2 days left of the current down wave from last Tuesday's high (sp'2081).

We'll likely floor tomorrow on 'jobs Friday'.... or via a flash-crash in the 1750s next Monday.

Either way... anyone short should be increasingly cautious as we move toward the sp'1920/00 zone.

--

*time for a little sun.. back soon

Pre-Market Brief

Good morning. US equity futures are severely lower, sp -41pts (2.1%), we're set to open at 1949 (overnight low, -55pts @ 1935. World equity markets continue to unravel, Germany -3.4%, Japan -2.3%, with China halted -7.3%.

sp'monthly2b - Guppy

Summary

*most of you will have heard of Guppy... some guy from Australia I believe (often appears on CNBC-Asia).

The point is... ANY action under 1900 opens the door to 1750 or so.... next Mon/Tuesday.

Something to consider for those who think 'buying the dip' might be a good idea.

--

So.. the market is NOT going to stop at the gap zone of 1954/51 today. Next support is the weekly/monthly lower bollinger in the 1920/00 zone.

If the market closes Friday near the lows, then the setup for Monday will be another 125/150pts lower... before first opportunity of a bounce.

Those with eyes on the bigger picture should not be surprised... at all.

---

Other issues...

Oil -3.5% in the low $32s. A break <$30 would offer a market crash to the 1700s.

Gold continues to hold a fear bid,, +$5.

--

Overnight action...

Germany: -3.4%.. having lost the giant 10K threshold. 8K is natural target.

Nikkei: -2.3% in the 17700s

China: opened sharply lower, market HALTED -7.3% @ 3115. There will clearly be a fierce battle around the 3K threshold, but I would imagine even the communists will wave the white flag.. and let the market implode to next support in the 2500s.

--

Have a good Thursday

sp'monthly2b - Guppy

Summary

*most of you will have heard of Guppy... some guy from Australia I believe (often appears on CNBC-Asia).

The point is... ANY action under 1900 opens the door to 1750 or so.... next Mon/Tuesday.

Something to consider for those who think 'buying the dip' might be a good idea.

--

So.. the market is NOT going to stop at the gap zone of 1954/51 today. Next support is the weekly/monthly lower bollinger in the 1920/00 zone.

If the market closes Friday near the lows, then the setup for Monday will be another 125/150pts lower... before first opportunity of a bounce.

Those with eyes on the bigger picture should not be surprised... at all.

---

Other issues...

Oil -3.5% in the low $32s. A break <$30 would offer a market crash to the 1700s.

Gold continues to hold a fear bid,, +$5.

--

Overnight action...

Germany: -3.4%.. having lost the giant 10K threshold. 8K is natural target.

Nikkei: -2.3% in the 17700s

China: opened sharply lower, market HALTED -7.3% @ 3115. There will clearly be a fierce battle around the 3K threshold, but I would imagine even the communists will wave the white flag.. and let the market implode to next support in the 2500s.

--

Have a good Thursday

Equity bulls should be very concerned

With equity indexes closing significantly lower for the second trading day of three this year, the equity bull maniacs should be concerned at increasingly bearish price action/structure. Indeed, seen on the bigger monthly charts, there is a giant multi-month bear flag that stretches from the Aug' low of sp'1867.

sp'monthly1b

sp'weekly6

Summary

*the weekly 'rainbow' candle remains an outright bearish red, having broken rising trend/support, and taking out the Dec'14th low of 1993.

--

First obvious target on the bigger weekly/monthly cycles is the lower bollinger band, in the 1920/00 zone.

A January net decline looks highly probable... certainly remaining below the 10MA (2044).

It remains important to keep in mind this bearish shift in the bigger trends is not just the case in US indexes, but across most world equity markets.

--

Looking ahead

Thursday will see the latest weekly jobs data.

*Fed officials Lacker and Evans will be talking on the economy.

--

Goodnight from London

sp'monthly1b

sp'weekly6

Summary

*the weekly 'rainbow' candle remains an outright bearish red, having broken rising trend/support, and taking out the Dec'14th low of 1993.

--

First obvious target on the bigger weekly/monthly cycles is the lower bollinger band, in the 1920/00 zone.

A January net decline looks highly probable... certainly remaining below the 10MA (2044).

It remains important to keep in mind this bearish shift in the bigger trends is not just the case in US indexes, but across most world equity markets.

--

Looking ahead

Thursday will see the latest weekly jobs data.

*Fed officials Lacker and Evans will be talking on the economy.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed significantly lower, sp -26pts @ 1990 (intra

low 1979). The two leaders - Trans/R2K, settled lower by -2.0% and

-1.5% respectively. Near term outlook is for continued weakness to the

gap zone of 1954/51. The bigger weekly/monthly cycles are more

suggestive of 1920/00.

sp'daily5

Trans

Summary

*a new multi-year low for the Trans of 7187.

--

As for the sp'500, further weakness to the 1960/50s looks a rather straight forward target. Whether the market will see extra weakness to the weekly/monthly lower bollinger - in the 1920/00 zone.. difficult to say.

In any case... mid term outlook is 100% bearish.

--

a little more later...

sp'daily5

Trans

Summary

*a new multi-year low for the Trans of 7187.

--

As for the sp'500, further weakness to the 1960/50s looks a rather straight forward target. Whether the market will see extra weakness to the weekly/monthly lower bollinger - in the 1920/00 zone.. difficult to say.

In any case... mid term outlook is 100% bearish.

--

a little more later...

Subscribe to:

Posts (Atom)