February 22nd 2012.....

First post...

https://permabeardoomster.blogspot.com/2012/02/can-anyone-fly-plane.html

--

This post will be the last under the online moniker of 'Permabear

Doomster'.

The name was always overly quirky, and directional in nature, even

though I really wasn't particularly that way, especially from summer

2013 onward, back when the SPX decisively broke above the 2000/2007

double top of the 1500s.

Since then, I've endeavoured to offer as balanced a view and

outlook as possible. Understandably, some of you have found it

difficult to deal with someone called 'PD', whilst also touting a m/t

bullish outlook.

Its September 5th, 2020, and its time for a name change.

Three new sites...

Subscriber site: https://www.subscriber.tradingsunset.com/

Home page: https://www.tradingsunset.com

New public blogger page: https://tradingsunset.blogspot.com/

–

Minor notes...

The 'Permabear Doomster' blog/site will be left up forever, or as

long as Alphabet/Google, maintain the servers.

The secondary pages of 'Fair value stocks', 'Buygoldsilverusa',

and 'MARCON' will remain active, at least for the moment.

As I'm using the same Blogger account for 'Trading Sunset', as I

did for 'Permabear Doomster', the original 'author' for 'Permabear

Doomster' posts, will now appear as 'Trading Sunset'.

I will be using Disqus on all three new sites.

–

After a little over eight and a half years, and 12,326 posts

(including this one), its time to retire a name.

This is the Permabear Doomster.... signing out.

Permabear Doomster

Market Analysis, Charts, Macro-Economics, and other nonsense

Saturday 5 September 2020

Friday 4 September 2020

Into the long weekend

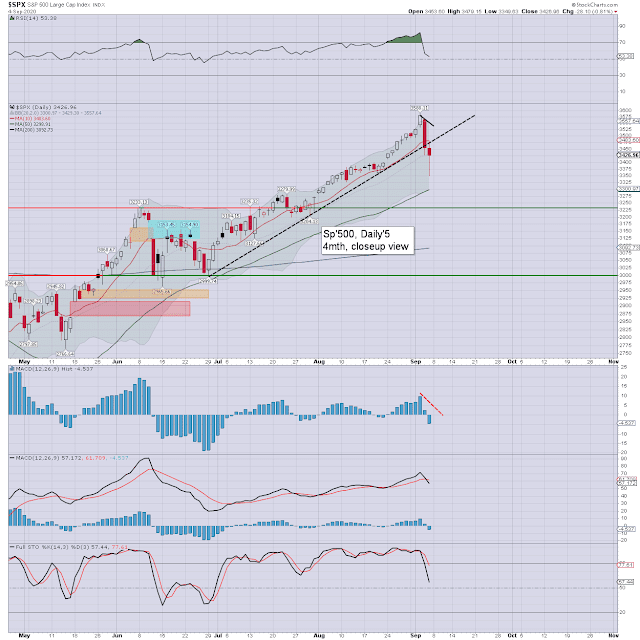

US equity indexes mostly closed on a weak note, sp -28pts (0.8%) at 3426. Nasdaq comp' -1.3%. Dow -0.6%. The Transports settled +0.5%.

sp'daily5

VIX'daily3

Summary

The day began with the US President appearing in pre-market...

US equities opened moderately positive, but the gains were shaky from the start. The Nasdaq quickly spiraled, and the rest of the market duly followed.

This morning's messy open no doubt annoyed the maximum number of Robinhood and Wallstreetbets lunatics who are still resolutely 'buying the dip'. Mr Market managed to not only suck in the more careless, but then to washout even the more resilient bulls.

For those using margin, it was not the best of days...

The afternoon saw choppy upside from a low of 3349 to 3455, and settling -28pts (0.8%) to 3426. Volatility printed a new cycle high of 38.28, cooling back to settle -8.5% to 30.75.

--

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

The day began with the US President appearing in pre-market...

US equities opened moderately positive, but the gains were shaky from the start. The Nasdaq quickly spiraled, and the rest of the market duly followed.

This morning's messy open no doubt annoyed the maximum number of Robinhood and Wallstreetbets lunatics who are still resolutely 'buying the dip'. Mr Market managed to not only suck in the more careless, but then to washout even the more resilient bulls.

For those using margin, it was not the best of days...

|

| "Everything burns" - The Dark Knight (2008) |

The afternoon saw choppy upside from a low of 3349 to 3455, and settling -28pts (0.8%) to 3426. Volatility printed a new cycle high of 38.28, cooling back to settle -8.5% to 30.75.

--

| Summer continues to fade |

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Thursday 3 September 2020

Thursday troubled skies

US equity indexes closed powerfully lower, sp -125pts (3.5%) at 3455. Nasdaq comp' -5.0%. Dow -2.8%. The Transports settled -2.5%.

sp'daily5

VIX'daily3

Summary

US equities opened on a weak note, despite better than expected jobs data.

The Nasdaq lead the way lower, spiraling into the morning, and pulling the rest of the market powerfully lower, including the more resilient Dow and Transports.

The US President was unquestionably rattled, blaming poll data for the equity swing lower...

Ironically, (from last night)...

.. and that tweet sure didn't age so well.

The late morning saw a bounce, but that was fully reversed, not helped by Fed official Evans, touting further QE.

The afternoon saw considerable chop, breaking a new low of 3427, with a choppy bounce into the close.

Volatility picked up, with the VIX printing 35.94, and settling +26.5% to 33.60.

--

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

sp'daily5

VIX'daily3

Summary

US equities opened on a weak note, despite better than expected jobs data.

The Nasdaq lead the way lower, spiraling into the morning, and pulling the rest of the market powerfully lower, including the more resilient Dow and Transports.

The US President was unquestionably rattled, blaming poll data for the equity swing lower...

Ironically, (from last night)...

.. and that tweet sure didn't age so well.

The late morning saw a bounce, but that was fully reversed, not helped by Fed official Evans, touting further QE.

The afternoon saw considerable chop, breaking a new low of 3427, with a choppy bounce into the close.

Volatility picked up, with the VIX printing 35.94, and settling +26.5% to 33.60.

--

|

| Appropriately troubled skies, as summer is fading fast. |

|

| Bullish SpaceX and Starlink |

--

Extra charts in AH (usually around 5pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to my intraday service.

For details and the latest offers, see: Permabeardoomster.com

Subscribe to:

Posts (Atom)